Porter’s 5 Forces Analysis

In today’s fast-changing competitive landscape, businesses face constant pressure from new technologies, shifting customer expectations, and aggressive industry rivals.

To navigate this complexity, leaders must rely on structured strategic tools rather than assumptions or short-term reactions. Models like porter's 5 forces help organizations understand what truly drives competition and profitability across industries. With markets becoming more interconnected and unpredictable, this level of clarity is no longer optional—it is essential.

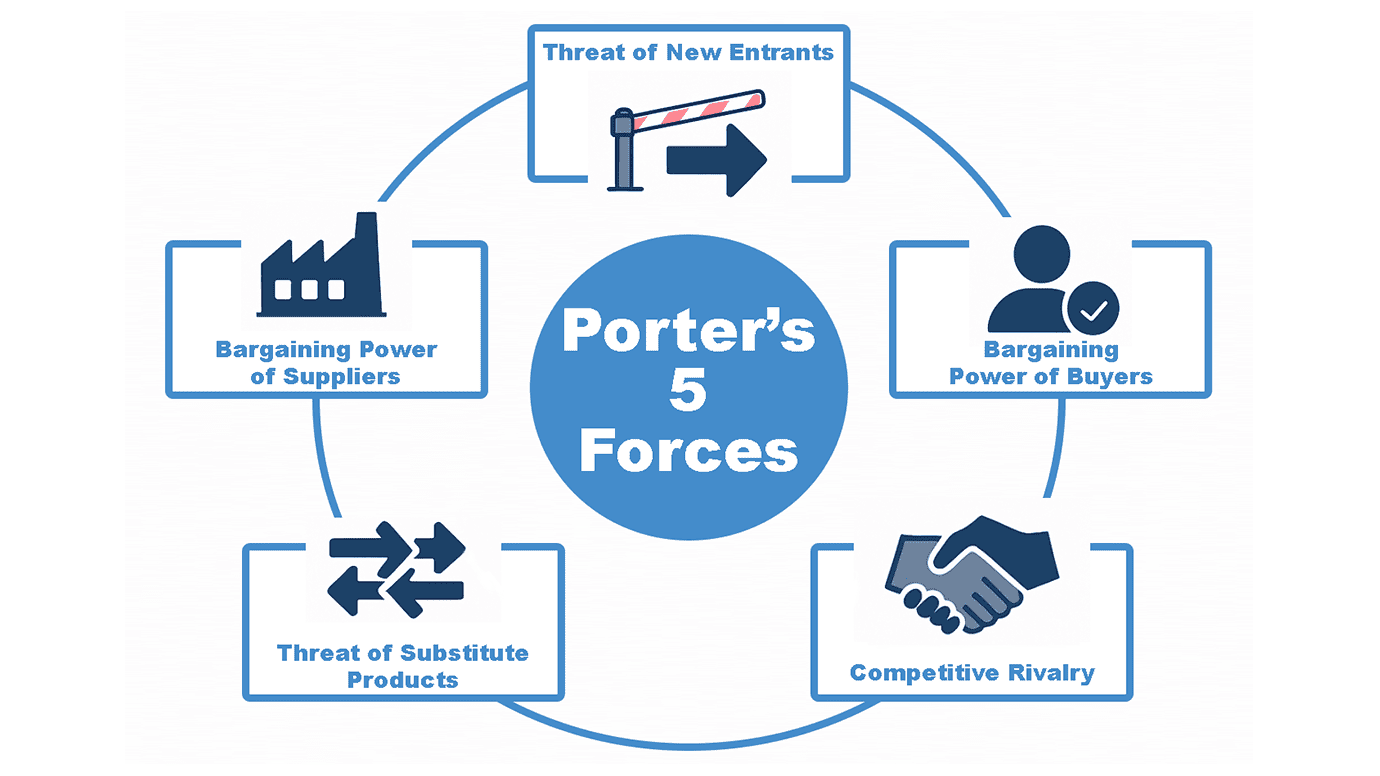

Strategic frameworks play a crucial role in ensuring long-term, sustainable growth. Instead of viewing competition only through direct rivals, businesses must evaluate the deeper forces shaping their industry’s structure. The porter’s five forces model allows decision-makers to examine supplier influence, buyer expectations, emerging substitutes, barriers to entry, and overall competitive rivalry. This kind of structured insight helps companies identify market gaps, anticipate threats, and build strategies that strengthen resilience and profitability. Whether a company is scaling operations, restructuring its business, or planning a new product launch, tools like 5 forces analysis offer a reliable foundation for strategic planning.

The importance of such frameworks is even more pronounced in manufacturing, supply chain management, and industrial operations—sectors where competition is often intense and margins are tightly regulated. As India evolves into a global manufacturing powerhouse, organizations entering new sectors or optimizing their existing operations must understand the 5 forces of competition that shape their markets. Applying the porter’s 5 competitive forces model helps companies assess industry attractiveness, enhance operational efficiency, and make confident market-entry decisions. By leveraging the competitive five forces framework effectively, businesses can transform uncertainty into opportunity and position themselves for sustainable growth in an increasingly competitive global economy.

What is Porter’s Five Forces Analysis?

Porter’s 5 forces analysis is one of the most influential strategic tools used by businesses to understand the level of competition within an industry and evaluate its long-term profitability. Developed by Harvard professor Michael Porter, this model helps leaders break down and examine the external factors that shape competitive intensity. At its core, 5 forces analysis is designed to reveal how different market players—suppliers, buyers, new entrants, substitutes, and existing competitors—impact a company’s ability to succeed. By studying these forces, organizations gain a deeper understanding of both opportunities and risks within their business environment.

Michael Porter created this framework to help companies move beyond simple competitor comparisons and adopt a broader, more comprehensive perspective. The goal behind porter’s 5 was to provide a structured method to analyze industry structure rather than focusing only on direct rivalry. As markets became more complex, Porter realized that profitability was influenced not just by competitors, but by powerful external forces. This led to the development of michael porter’s 5 forces analysis—a model now widely used across industries, from manufacturing to technology.

The true value of porter’s five forces lies in its ability to assess industry attractiveness. By evaluating the 5 forces of competition, companies can identify which markets offer sustainable profitability and which ones pose long-term challenges. Whether a business is entering a new segment, planning expansion, or optimizing operations, these five forces framework provides insights that guide strategic decisions. Using these forces effectively enables organizations to understand where power lies and how to position themselves for competitive advantage.

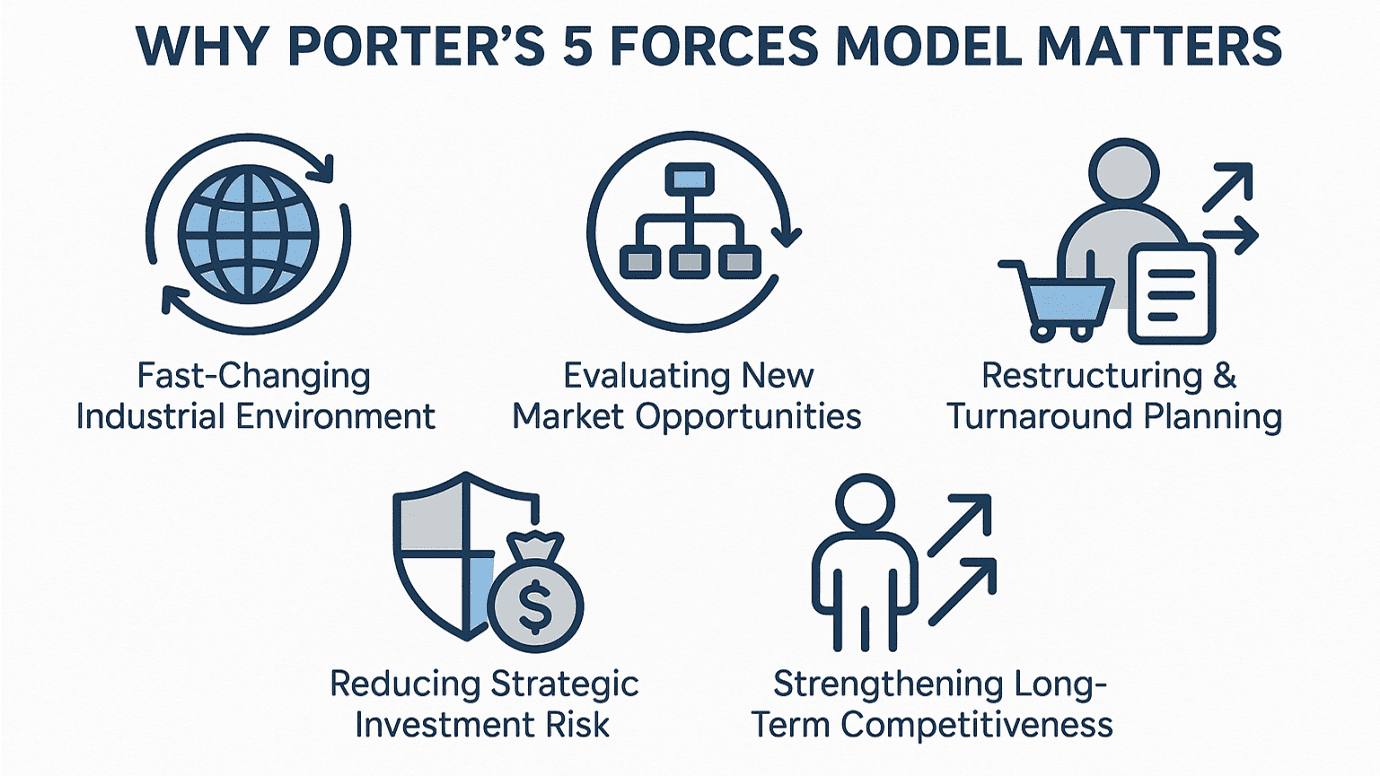

Why Porter’s 5 Forces Model Matters?

The relevance of porter’s 5 forces has grown significantly in India’s rapidly evolving business ecosystem. With industries transforming at record speed, companies need structured frameworks like 5 forces analysis to stay competitive. Here’s why the model is especially important for Indian businesses today:

Supports Decisions in a Fast-Changing Industrial Environment

- India is witnessing massive innovation across manufacturing, automotive, electronics, and supply chain sectors.

- Using porter’s five forces, companies can understand how technological shifts and new competitors impact profitability.

- The framework ensures leaders respond strategically, not reactively.

Helps Evaluate New Market Opportunities

- Businesses considering expansion into new regions or product lines rely on these forces to judge market attractiveness.

- By examining all five forces, organizations can identify high-growth sectors and avoid markets with excessive competitive pressure.

Essential for Restructuring and Turnaround Planning

- Companies undergoing transformation use porter’s 5 competitive forces to analyze their current position.

- It helps in identifying weaknesses in supply chain, pricing power, customer dependence, or operational challenges.

- This makes restructuring decisions more data-driven and effective.

Reduces Risk in Strategic Investments

- The 5 forces of competition reveal hidden risks linked to supplier dominance, buyer bargaining power, or substitute products.

- Indian businesses can make safer, better-informed investment decisions through this analysis.

Strengthens Long-Term Competitiveness

- By understanding these forces, companies can refine strategy, improve negotiation power, and build sustainable advantages.

- This is crucial as India becomes a global manufacturing and innovation hub.

The Porter’s 5 Forces Explained

The porter’s 5 forces framework remains one of the most widely used strategic tools in business analysis. By breaking down these forces that shape every industry, companies can understand the structural drivers of profitability, the intensity of competition, and the long-term viability of a market. Michael Porter’s 5 forces analysis helps leaders go beyond surface-level competition and examine all forces that influence their strategic decisions. Below is a comprehensive breakdown of each force and how it applies particularly to industries in India.

Threat of New Entrants

- The threat of new entrants refers to how easy or difficult it is for new companies to enter an industry and compete with established players. Within the porter’s five forces model, this force is critical because a high likelihood of new entrants can reduce market share, drive down prices, and increase operational pressure.

- This measures how likely it is for new competitors to enter a market and disrupt existing structures. When entry barriers are low, industries experience more frequent disruption.

What Impacts It

- Entry Barriers: Industries with significant entry barriers—such as high capital investment, technical expertise, brand loyalty, or strong distribution networks—experience lower competitive pressure. For example, heavy manufacturing, pharmaceuticals, and automotive sectors typically have high barriers.

- Economies of Scale: Established businesses benefit from large-scale operations, allowing them to reduce per-unit costs. When economies of scale are significant, it becomes difficult for smaller or new companies to compete profitably.

- Government Regulations (Make in India): India’s regulatory environment influences entry possibilities. While initiatives like “Make in India” encourage industrial participation, compliance, certifications, and environmental approvals still create barriers that can deter new players. For many sectors, these regulatory requirements help protect existing companies from sudden competition.

Overall, in industries with high barriers, this force predict lower risk of new entrants, supporting stronger profitability.

Bargaining Power of Suppliers

- This is a key component of the competitive five forces It examines how much influence suppliers have over pricing, quality, and supply consistency.

- This force evaluates the power suppliers hold in an industry. When suppliers are few, or when their materials are highly specialized, their influence increases significantly.

What Impacts It

- Raw Material Availability: Industries dependent on rare or limited raw materials—such as electronics, specialty chemicals, or automotive components—tend to face stronger supplier power. A shortage of raw materials can increase costs and disrupt operations.

- Logistics & Supply Chain Dependency: In manufacturing-intensive sectors, reliance on complex supply chains increases vulnerability. If suppliers manage critical logistics or maintain control over transportation networks, businesses become dependent on their timelines and pricing.

For Indian companies, especially those in export-driven industries, this force among the five forces highlights supplier power as a major factor in profitability. If suppliers dominate the market, they can dictate terms, leading to higher operational costs and reduced margins.

Bargaining Power of Buyers

- This is another crucial factor within porter’s five forces. Buyers hold power when they can influence pricing, demand better quality, or easily switch to competitors.

- This force refers to the ability of customers or clients to affect the pricing and quality of products or services. When buyers have strong influence, companies face pressure to lower prices or enhance offerings.

What Impacts It

- Customer Expectations: Modern buyers are informed, price-sensitive, and demand higher value. In B2B industrial markets, large buyers like OEMs or multinational corporations exert significant pressure on manufacturers to reduce costs and increase performance.

- Price Sensitivity: When buyers perceive minimal differentiation between products, price becomes the primary competitive factor. In such cases, the five forces framework shows high buyer power, leading to squeezed margins.

Industries such as packaging, components manufacturing, textiles, and FMCG often deal with strong buyer power due to standardized products and numerous alternatives. Using this force, companies can identify areas where value differentiation may help reduce buyer dominance.

Threat of Substitute Products

- The threat of substitute products measures how likely customers are to switch from one product or service to an alternative that fulfills the same need. This force is critical in evaluating long-term sustainability.

- This force examines the availability and attractiveness of products that serve the same purpose as the industry’s offerings. High substitution reduces pricing power and profitability.

What Impacts It

- Technological Evolution: Rapid advancements in technology often introduce new substitutes. Automation replacing manual labor, digital services replacing physical offerings, or renewable materials replacing traditional ones all increase the threat of substitutes. Industries must continuously innovate to stay relevant.

- Alternative Materials or Processes: In manufacturing, alternatives like recycled materials, 3D printing, robotics, or AI-driven solutions can replace traditional methods. For instance, electric vehicles disrupt conventional automotive markets, while biodegradable materials challenge plastic-based packaging.

This force out of porter’s 5 framework suggests that industries facing high substitution threats must invest in innovation, R&D, and value differentiation to maintain their market position.

Competitive Rivalry

- The final force—competitive rivalry—is often the most visible in the 5 forces analysis It measures the intensity of competition among existing industry players.

- It evaluates how companies within the same industry compete in terms of pricing, product differentiation, innovation, marketing, and customer service. High rivalry leads to lower profitability and greater business risk.

What Impacts It

- Industry Growth Rate: When industries grow rapidly, companies can expand without directly confronting competitors. However, in slow-growth or saturated industries, businesses must fight harder for market share, increasing competitive pressure.

- Market Fragmentation: Industries with many competitors offering similar products—such as textiles, small machinery, or consumer goods—experience high rivalry. Conversely, industries dominated by a few major players may have lower rivalry but higher barriers to entry.

In India, highly fragmented sectors such as retail, food processing, and manufacturing face intense rivalry. As businesses compete on price rather than innovation, profit margins shrink. The porter’s 5 competitive forces framework helps leaders identify whether rivalry is driven by cost pressures, product similarity, or customer expectations.

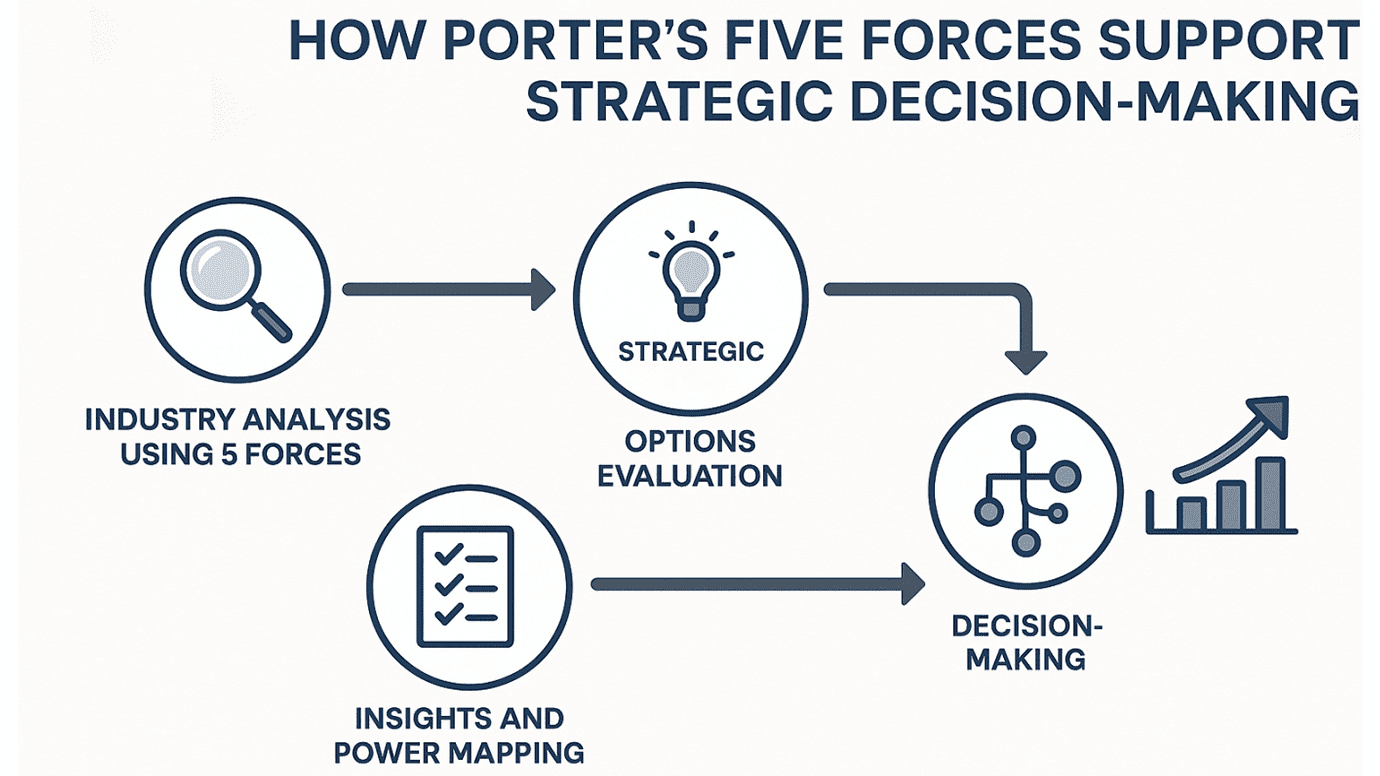

How to Use Porter’s Five Forces for Strategic Decision-Making

The true power of porter’s 5 forces lies not just in understanding industry dynamics, but in using these insights to make strategic, data-driven decisions. Whether a business is evaluating new opportunities, optimizing internal operations, or strengthening its market position, 5 forces analysis serves as a reliable foundation for long-term planning. By examining all five forces, organizations can identify where power lies and how to respond effectively.

Evaluating New Business Opportunities

When entering a new market, leaders must analyze the industry’s structure using porter’s 5 forces.

- A high threat of new entrants signals lower entry barriers and greater risk of competition.

- Strong bargaining power of buyers may lead to price pressure.

- A high threat of substitute products indicates the need for differentiation.

Using the complete 5 forces, enables companies to assess industry attractiveness, potential profitability, and the competitive intensity they must prepare for.

Improving Operational Efficiency

Operational efficiency improves when businesses understand the power dynamics affecting cost and performance.

- If the bargaining power of suppliers is high, companies may explore alternative sourcing, backward integration, or long-term contracts.

- When competitive rivalry intensifies, organizations must optimize processes, enhance quality, and reduce waste to remain profitable.

Through these forces analysis, leaders gain clarity on where operational improvements yield the greatest strategic impact.

Strengthening Supply Chain Resilience

In industries where supply chains are complex, applying porter’s five forces helps identify vulnerabilities.

- High supplier concentration amplifies the bargaining power of suppliers, making cost structures unstable.

- Dependence on limited logistics channels increases operational risk.

Recognizing these pressures through the competitive five forces model empowers businesses to diversify suppliers, build redundancy, and improve supply planning.

Identifying High-Growth Markets

Organizations aiming for expansion use porter’s 5 competitive forces to pinpoint high-potential segments.

- Low rivalry and minimal substitutes signal strong growth prospects.

- Favorable buyer dynamics and manageable supplier power indicate high profitability.

By assessing each of the 5 forces, companies can prioritize markets that offer sustainable competitive advantage.

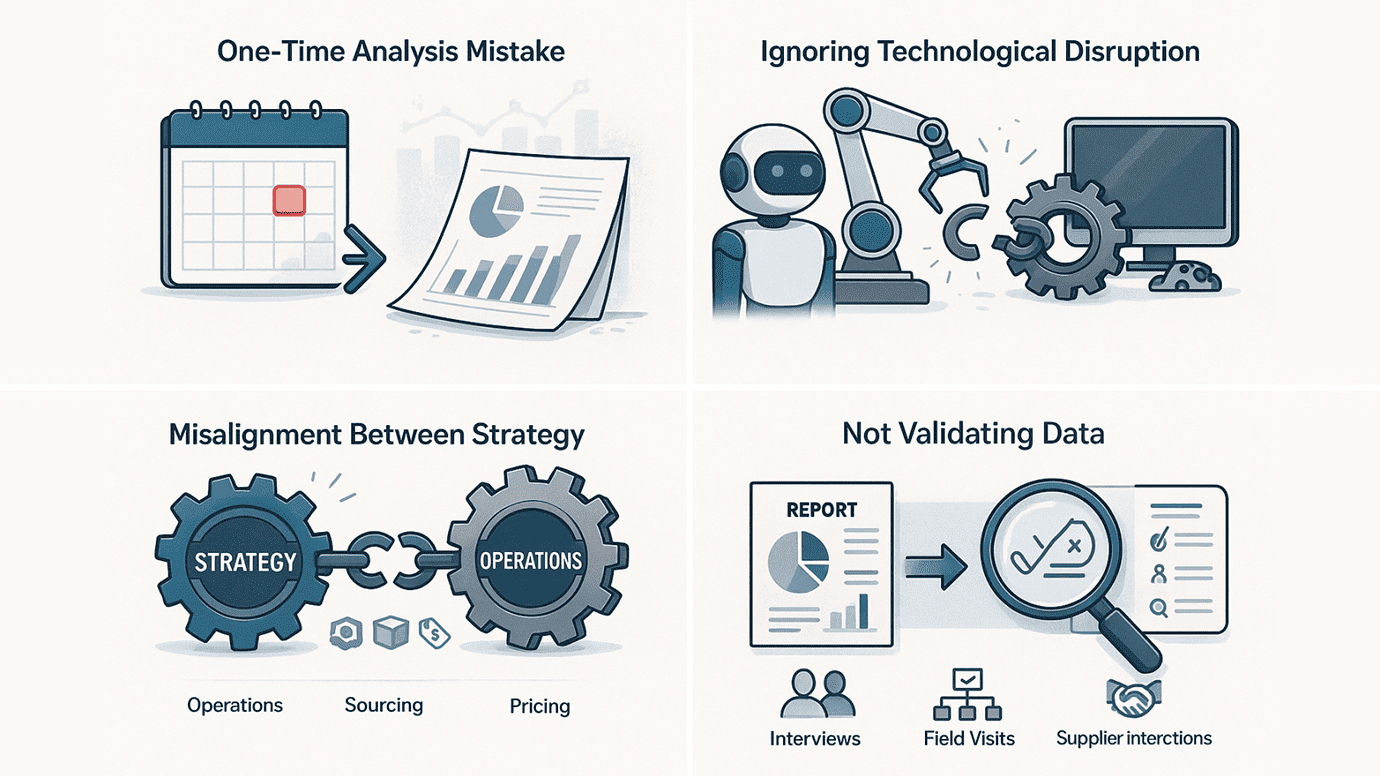

Common Mistakes Companies Make When Using Porter’s Five Forces

While porter’s 5 forces are one of the most powerful strategic tools available, many organizations misuse or misunderstand it, leading to incomplete insights or flawed decisions. To get the full value from 5 forces analysis, companies must avoid several common pitfalls that limit the accuracy and reliability of the framework.

Treating the Analysis as a One-Time Exercise

One of the biggest mistakes is viewing porter’s five forces as a static tool rather than a continuous strategic practice. Industries evolve rapidly—new competitors enter the market, regulations shift, and technologies disrupt traditional models. When companies conduct analysis of these forces only once and fail to update it regularly, they miss critical changes such as rising competitive rivalry or strengthening bargaining power of suppliers. To remain effective, insights from the five forces should be revisited quarterly or annually, depending on the speed of industry change.

Ignoring Technological Disruption

Many businesses underestimate the role of technology in altering the 5 forces of competition. Innovations can dramatically increase the threat of substitute products, enable new entrants to bypass traditional barriers, or shift buyer expectations. For example, automation and AI tools may reduce dependency on traditional labor, creating substitutes that reshape cost structures. Ignoring these shifts leads to outdated evaluations within porter’s 5 forces analysis.

Not Aligning Operations and Supply Chain Insights

Companies often fail to connect porter’s 5 insights with their operational realities. For instance, high bargaining power of buyers should influence pricing strategies and product customization, while strong bargaining power of suppliers should drive sourcing diversification or inventory planning. When operational teams do not integrate findings from these forces, the analysis loses its practical impact.

Not Validating Data with On-Ground Assessments

Another common mistake is relying solely on secondary research without verifying assumptions through real-world insights. Market reports may not fully capture regional supplier behavior, local regulations, or emerging competitors. Validation through interviews, field visits, and supplier/buyer discussions ensures that conclusions from the competitive five forces model are grounded in reality, not just theory.

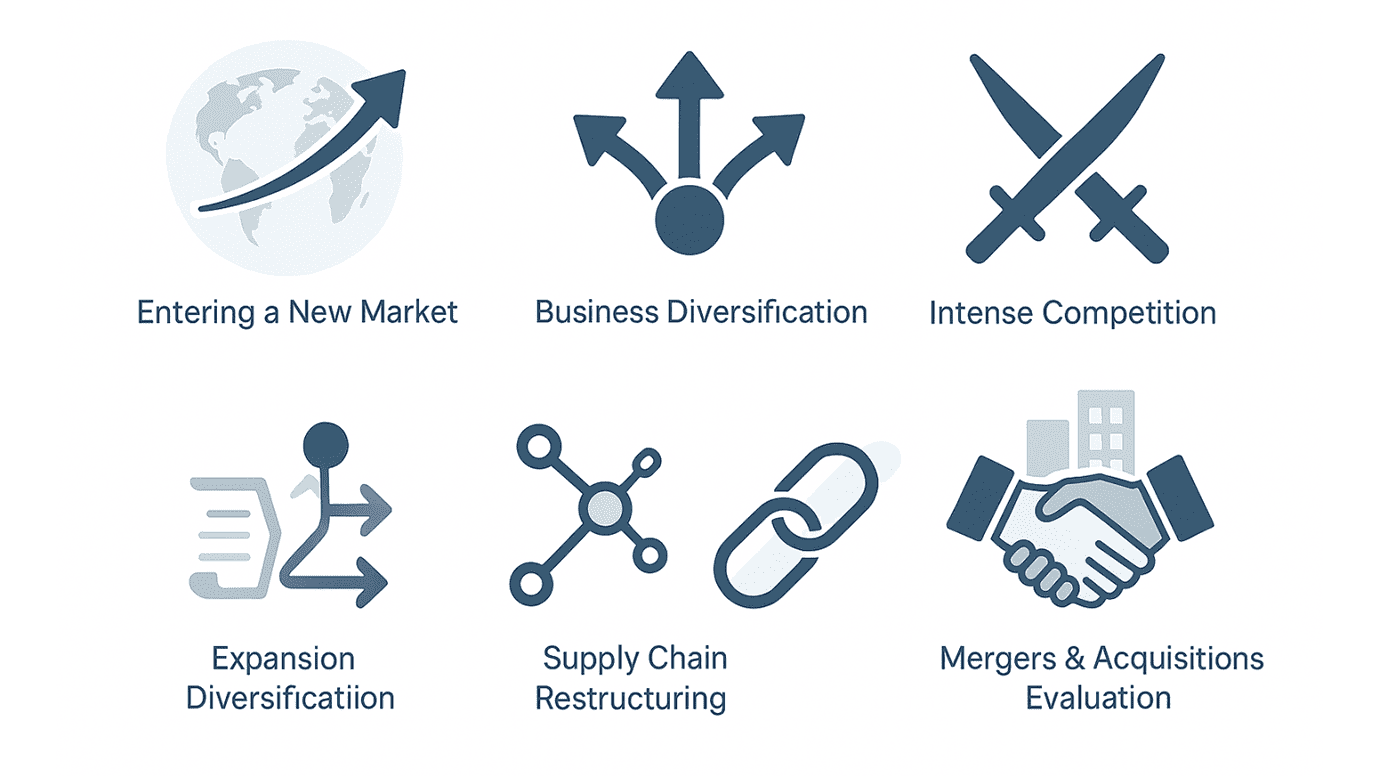

When Should Businesses Conduct Porter’s Five Forces Analysis?

Understanding when to use porter’s 5 forces is just as important as knowing how to apply it. The framework provides maximum value when businesses use it at key decision points or during major strategic transitions. By applying these forces at the right moments, companies can uncover risks, identify opportunities, and make far more informed decisions. Below are the most important situations where conducting michael porter’s 5 forces analysis becomes essential.

Before Entering a New Market

When expanding into a new region or launching a new product category, leaders must understand the 5 forces of competition shaping that industry.

- A high threat of new entrants may indicate low entry barriers and intense rivalry.

- Strong bargaining power of buyers may signal price pressures.

- Numerous substitutes may increase the threat of substitute products.

Using five forces analysis helps determine whether the market is genuinely profitable or saturated with risk.

During Expansion or Diversification

Companies planning to diversify into adjacent sectors should evaluate how the five forces differ from their current industry.

- New suppliers may have stronger influence, raising the bargaining power of suppliers.

- Competitors may be more aggressive, escalating competitive rivalry.

A thorough porter’s five forces review ensures diversification is strategically sound.

When Facing Rising Competition

If industry rivalry increases due to new players, pricing wars, or shifting customer expectations, conducting 5 forces analysis becomes critical. It helps identify whether pressure is coming from buyers, substitutes, or aggressive entrants. Companies can then redesign strategies based on insights from porter’s 5 competitive forces.

During Operational or Supply Chain Restructuring

When restructuring operations, supply networks, or procurement models, insights from competitive five forces highlight where power imbalances exist.

- High supplier concentration increases the bargaining power of suppliers, requiring sourcing diversification.

- Changing buyer demands may increase the bargaining power of buyers, impacting pricing strategies.

During M&A Evaluations

Before acquiring or merging with another company, conducting porter’s 5 forces analysis reveals the industry’s structural risks. Understanding these forces ensures the M&A decision aligns with long-term strategic goals.

FAQs

A. Porter’s 5 forces is a strategic framework used to evaluate industry competitiveness. It is important because it gives businesses a structured way to analyze market conditions, profitability, and long-term sustainability using these forces.

A. Porter’s five forces helps companies assess industry attractiveness by examining factors like the threat of new entrants, bargaining power of buyers, and availability of substitutes. This makes the analysis essential for informed market-entry decisions.

A. The bargaining power of suppliers affects cost structures and supply stability. In porter’s 5 competitive forces, strong supplier power can reduce profitability and increase operational risk.

A. By reviewing the five forces, companies can identify where operational pressures originate—such as high supplier influence or intense competitive rivalry—and adjust their processes to remain efficient and profitable.

A. The threat of substitute products determines how easily customers can shift to alternatives. In michael porter’s 5 forces analysis, high substitution pressure forces companies to innovate and differentiate.

A. Using the full 5 forces of competition model allows businesses to understand the drivers behind increasing competitive rivalry, helping them refine pricing strategies, product offerings, and marketing efforts.

A. A business should use five forces analysis before entering new markets, during diversification, when restructuring supply chains, or when evaluating mergers and acquisitions.

A.Because industries evolve rapidly, companies should revisit porter’s 5 insights at least annually—or more frequently in dynamic sectors—to ensure the analysis reflects current competitive conditions.

Conclusion

In an increasingly dynamic and competitive business landscape, organizations cannot rely on intuition or outdated assumptions to guide strategic decisions. This is where structured industry evaluation becomes essential. The porter’s 5 forces framework continues to stand out as one of the most reliable tools for understanding both the current market environment and long-term industry dynamics. By analyzing each of the five forces—including the threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitute products, and the level of competitive rivalry—leaders gain a comprehensive view of the competitive pressures shaping their industry.

Rather than focusing solely on direct competitors, porter’s 5 forces analysis encourages businesses to examine every structural factor influencing profitability. When used consistently, these forces becomes a foundation for long-term strategic strength, guiding companies as they evaluate markets, refine business models, and anticipate disruptions. Whether you’re entering a new industry, launching a product, restructuring operations, or planning long-term investments, the insights derived from porter’s five forces can significantly improve the quality of decision-making.

In today’s high-velocity environment, proactive strategy is no longer optional—it is a necessity. Businesses that regularly apply the competitive five forces model position themselves to navigate uncertainty with confidence, respond effectively to changing market forces, and capture new opportunities before competitors do. The time to act is now. By adopting porter’s 5 competitive forces as a central component of your strategic planning, your organization can build resilience, strengthen market presence, and create sustainable growth in an increasingly competitive global economy.

For detailed information regarding our services for different sectors, you can explore our Homepage.